Investor protection measures and regulatory chill

Treaty-based investment protection measures, including Investor-State dispute settlement (ISDS) mechanisms and arbitration tribunals, are du jour manifestations of the corporate capture of inter-governmental and multilateral trade negotiations.

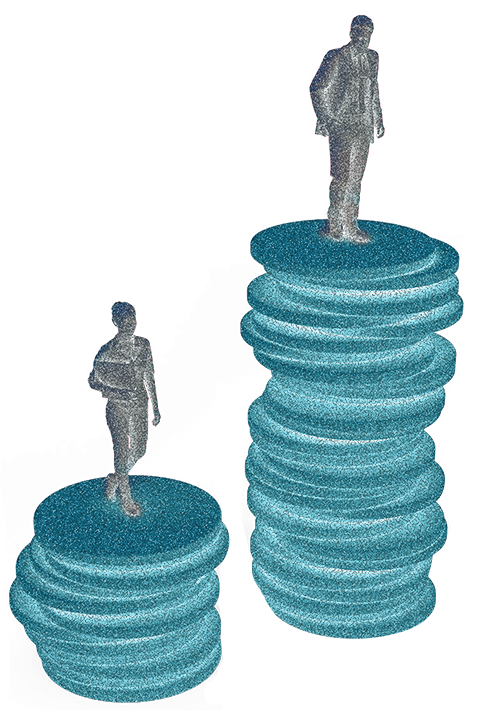

In essence, treaty-based investment protection measures give corporations the right and a forum to challenge governmental decisions and sue for redress. What often occurs,especially in the Global South,is that governments do not have the resources to defeat corporations at theWorld Trade Organization(WTO), regional courts, or arbitration tribunals.

The Transnational Institute (TNI) (Netherlands) and the Colectivo de Abogados José Alvear Restrepo (CAJAR) (Colombia) write: “A sovereign policy focused on the well-being of the population, the protection of the environment and climate, and the promotion of local economy companies is irreconcilable with the rights granted to investors by investment protection treaties. If Colombia wants to break the vicious circle of receiving ISDS claims every time it wants to modify its policies and regulations, it is essential to review its investment protection regime. The only way Colombia can avoid new investment arbitrations is by denouncing the treaties and trade and investment agreements already signed and refraining from renewing or signing new ones, as they enable more claims.”

With global warming worsening and the energy transition accelerating, ISDS is also associated with the term regulatory chill. According to Kyla Tienhaara: “It is hypothesized that fossil fuel corporations will emulate a tactic employed by the tobacco industry – that of using ISDS to induce cross-border regulatory chill: the delay in policy uptake in jurisdictions outside the jurisdiction in which the ISDS claim is brought. Importantly, fossil fuel corporations do not have to win any ISDS cases for this strategy to be effective; they only have to be willing to launch them.”