Mexican Afores invest in FIBRAs despite impact on housing access

12 de December de 2022

Translated from Spanish

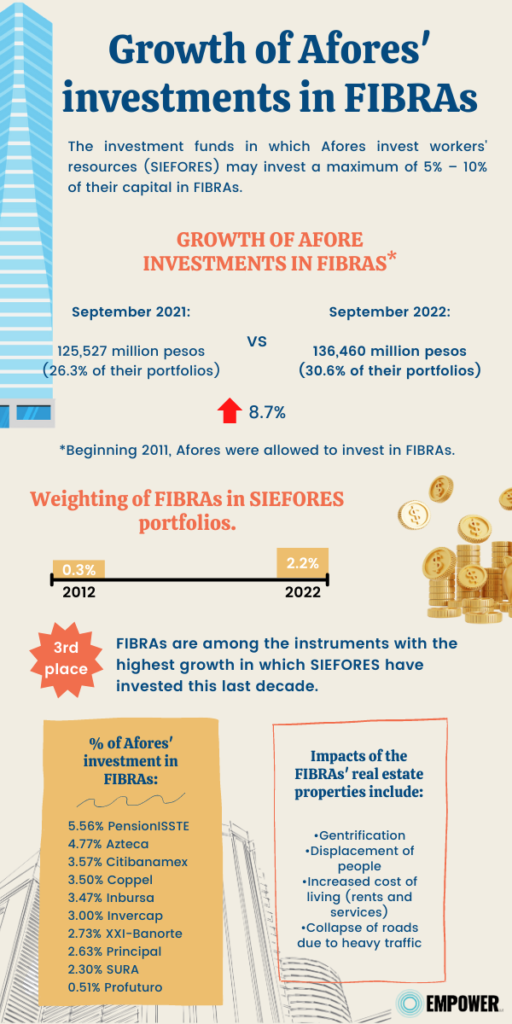

Investments by Mexican Retirement Fund Administrators (Afores, in Spanish) in Real Estate Investment Trusts (FIBRAs, in Spanish) grew by 8.7% over the past year. While this represents diversification for the savings of workers who assign the administration of their retirement funds to private companies, the fact that Afores increasingly invest in FIBRAs also means that more resources are available to perpetuate bad practices that violate the right to adequate housing in cities that are being overwhelmed by real estate hoarding. This dynamic generates a cycle whereby workers indirectly invest their savings, through Afores, in projects that might adversely affect themselves or their neighbors.

By Claudia Ocaranza

On the inside, stores, lights, a movie theater, restaurants, luxury, and offices are spread across four floors totaling 120,000 m2 of rentable space. This is the Torre Mitikah shopping center located in Mexico City. On the outside, however, there’s a stark contrast: traffic, road closures, repurposed streets, and neighboring residents unhappy with the complex owned by Fibra Uno (BMV:FUNO), which claims to be the tallest skyscraper in the city at a height of 267 meters and over 1 million m2 of space with permission for mixed land use.1“Mitikah abre su centro comercial de 120,000 metros cuadrados,” El Economista, 23 September 2022, www.eleconomista.com.mx/econohabitat/Mitikah-abre-su-centro-comercial-de-120000-metros-cuadrados-20220923-0089.html. Behind Mitikah is not only FUNO — one of 17 Real Estate Investment Trusts (FIBRAs) listed on a Mexican stock exchange — but also those who invest there, including the Retirement Fund Administrators (Afores). “Around 40% of FUNO’s investments come from local investors, of which 17% are Afores,” stated Karen Mora, Director of Sustainability and Foundation of Fibra Uno, to news media organizations.2Verónica González, “Fibra Uno quiere que toda la deuda que emita tenga atributos ASG,” Real Estate Market & Lifestyle, 9 June 2022, www.realestatemarket.com.mx/noticias/capital-markets/37911-fibra-uno-quiere-que-toda-la-deuda-que-emita-tenga-atributos-asg.

Although publicly available information does not indicate exactly which Afores have invested in Mitikah or other Fibra Uno projects, data does show an increased presence of FIBRAs in Afores’ investment portfolios, which are responsible for managing over 72 million retirement savings accounts for Mexican workers.3“Cuentas Administradas por las Afores,” Comisión Nacional del Sistema de Ahorro para el Retiro (Consar), data through October 2022, www.consar.gob.mx/gobmx/aplicativo/siset/CuadroInicial.aspx?md=5. While some mechanisms are being implemented by Afores to ensure that FIBRAs’ real estate projects comply with environmental, social, and governance (ESG) criteria, there are numerous cases where the construction or conversion and remodeling of properties with commercial, residential, office, industrial, and mixed uses alter social dynamics and transform people’s lives.

For Rosalba González Loyde, an urban housing researcher, the impact of FIBRAs’ projects “has to do with the area where they’re inserted,” from the supply of basic resources and transportation connections between outlying areas and urban centers, to the collapse of roads due to heavier traffic in more central locations, and gentrification. Eventually, this includes the displacement of people who have lived in areas for years and who, faced with higher rents and more expensive businesses, end up leaving.

“If you add commerce and offices, it changes everything considerably. Even though these factors are laid out in urban mitigation plans, these plans are not that efficient,” said González Loyde, professor at the National Autonomous University of Mexico (UNAM), in an interview with Empower.

According to Natalia Lara, member of Acción Comunitaria Pedregal, one of the neighborhood organizations that have been protesting Mitikah and other real estate projects in the southern part of Mexico City, the presence and financing of these types of projects turn the city into a commodity in which the remediation measures deployed to resolve the negative effects come up short or even cause more damage.

“FUNO removed Real de Mayorazgo Street to use it as a driveway for Torre Mitikah. This was supposedly a mitigation measure. However, an amparo lawsuit was filed so that the street wouldn’t be lost. The suit was victorious, but the Court’s resolution was disobeyed,” said Lara in an interview with Empower. She added that another mitigation measure was to be the creation of a medical clinic within the pueblo of Xoco, which has not happened despite the fact that the building was already inaugurated.

According to Arturo Aparicio, a lawyer who accompanies the Pueblo de Xoco collective, “Mitikah Ciudad Vida, which consists of 10 skyscrapers, has broken the identity and social fabric of Pueblo de Xoco and, with it, gradually dislodged people from their territory until the point of extinction. What the project seeks is the disappearance of the pueblo,” he told Empower.

The Pueblo de Xoco collective denounced the Secretariat of Indigenous Peoples, Neighborhoods, and Residential Communities of Mexico City (SEPI) for allowing Mitikah to appropriate the “space of the people.” In this sense, it recently announced having won a “definitive suspension so that SEPI and the Government of Mexico City refrain from carrying out acts that tend to evict and/or banish the Pueblo de Xoco from its territory.”4“¡Poder Judicial de la Federación ordena al Instituto de Planeación de la CDMX suspenda reuniones vecinales en Xoco para la aprobación del PGDU y PGOT!,” Statement by Pueblo de Xoco, 5 December 2022, https://twitter.com/PueblodeXoco/status/1599814150074486785?t=OrZ3pc_-_G0SSkS9Fq3Nzg&s=35.

“The resolution, despite having been published after Mitikah was already inaugurated, has a ‘political effect’ of dignifying the Pueblo de Xoco and prevents SEPI from issuing another notice that would allow the real estate sector to appropriate other important spaces for the area’s residents,” said Aparicio.

The role of the Afores

Currently, SIEFORES — the investment funds divided by age groups that are managed by Afores and invest workers’ savings — can invest a maximum of 5% to 10%, depending on the type of SIEFORE, of their managed capital in FIBRAs and other real estate investment vehicles, including FIBRAS-E for energy and infrastructure projects,5“Límites del Régimen de Inversión,” Consar, www.consar.gob.mx/gobmx/Aplicativo/Limites_Inversion. according to the SIEFORES Investment Regime.

From 2011, when investment in FIBRAs began, through September 2022, Afores invested 136,460 million Mexican pesos in FIBRAs, equivalent to 30.6% of their portfolios.6“El SAR en números. Cifras al cierre de septiembre de 2022,” Consar, www.gob.mx/cms/uploads/attachment/file/768624/El_SAR_en_num_sept2022.pdf. This represents 8.7% annual growth compared to the same month last year, when Afores invested 125,527 million pesos, or 26.3% of their portfolios,7“El SAR en números. Cifras al cierre de septiembre de 2021,” Consar, www.gob.mx/cms/uploads/attachment/file/682127/El_SAR_en_num_sept2021.pdf. according to data from the National Commission of the Retirement Savings System (Consar).

Ten years ago, the weighting of FIBRAs in SIEFORES’ portfolios amounted to only 0.3%; today it’s 2.2%. Government debt continues to be the instrument in which SIEFORES invest the most, but its weighting in portfolios has fallen from 61.4% a decade ago to 52.4% today.

FIBRAs rank third among the instruments in which SIEFORES’ investments have grown the most over the last ten years. The top two places are occupied by structured instruments and international, equities.

By the end of October 2022, the percentages of Afores’ investment in FIBRAs with respect to the value of the managed portfolios were as follows:8“Inversión en fibras,” Consar, data through October 2022, www.consar.gob.mx/gobmx/general/panorama_sar/fibras.aspx. PensionISSSTE 5.56%, Azteca 4.77%, Citibanamex 3.57%, Coppel 3.50%, Inbursa 3.47%, Invercap 3%, XXI-Banorte 2.73%, Principal 2.63%, SURA 2.30%, and Profuturo 0.51%.

Only Afore Azteca and Profuturo decreased the weighting of their investments in FIBRAs within their portfolios with respect to the same month last year.9“Inversión en fibras,” Consar, data through October 2021, accessed September 2022, web.archive.org/web/20211124094201/http://www.consar.gob.mx/gobmx/general/panorama_sar/fibras.aspx. Coppel and XXI-Banorte were the two that increased their investment the most, at 33.58% and 33.17% respectively.

Although Consar publishes some investment information, it fails to disclose which Afores invest in which FIBRAs projects. According to Consar’s responses to freedom of information requests submitted for this article,10Response to freedom of information request number 330009522000299, Consar. a breakdown of the percentages of each Afore’s investment in individual projects of each Mexican FIBRAs is a trade secret and thus confidential information.11Response to freedom of information request number 330009522000300, Consar.

According to the lawyer for financial matters Paulo Díez Gargari, it’s a mistake not to disclose this information because it makes it impossible for those with retirement savings to decide in which Afore to invest.

“The Law of the Retirement Savings System does not establish a specific obligation of the Afores to disclose in which instruments they invest in detail. The only thing it says they must disclose in general is the type of instrument. An attempt has been made to justify this as a measure to promote competitiveness so that other Afores do not find out their competitor’s strategy, which is absurd. Even if that were true, what cannot be said is that the commercial interest of the Afores is superior to the public’s right to know what Afores invest in so as to decide where to put their savings,” said Díez in an interview with Empower.

This could add to Mexican retirement savers’ lack of knowledge about how the Afores and SIEFORES work, as well as the impact of investments made with their money.

“What would happen if we told people that part of their Afore invests in a certain project that might be the same one that’s displacing them or that’s going to displace their children. People are ignorant about how Afores work because they lack transparency,” said González Loyde.

Moisés Pérez, a Retirement Savings System (SAR) analyst and founder of the Yo Jubilado initiative, believes that there’s also a lack of interest among savers in general, which makes it difficult to perceive a need for more accountability on the part of the Afores and the Consar that would allow Afores clients to make decisions about their investments.

According to the expert, given how the SAR currently operates, “the system has performed well and it would not be the same if it worked on an individual level,” he said in an interview with Empower.

For Leilani Farha, director of The Shift, a global initiative to protect the right to adequate housing, transparency about Afores’ investments in FIBRAs becomes necessary for two reasons: a cultural issue and for governments to monitor real estate developments.

“On one hand, it may be that Mexicans do not have the culture of requesting accountability from their pension plans, but you can’t start creating that culture if you don’t have transparency. On the other hand, the government has to implement the right to housing and cannot monitor who’s investing in what and its impact if it also doesn’t have access to that information because it has a duty to keep rents low, to keep them affordable, and the only way to do that is through transparency,” said the former UN special rapporteur on adequate housing in an interview with Empower.

The FIBRAs’ version

Only six of the 17 real estate FIBRAs listed on the Mexican Stock Exchange (BMV) or the Institutional Stock Exchange (BIVA) registered any data in their 2021 reports about the participation of Afores in their Real Estate Trust Bond Certificates (CBFIs), the equity securities that investors buy.12Recompra de títulos,” Hablemos de Bolsa, BMV, 19 August 2021, https://blog.bmv.com.mx/2021/08/recompra-de-titulos. FIBRA Educa (BMV:EDUCA), owner of ICEL Universities, reported that, “according to the type of holder, some of the Afores jointly participate in over 25% of the CBFIs in circulation.”13“Reporte anual por el ejercicio que terminó el 31 de diciembre de 2021,” FIBRA EDUCA, p. 109, fibraeduca.com/media/fibraeduca/pdf/20220429-informe-anual-2021.pdf.

FIBRA Monterrey (BMV:FMTY) reported that institutional investors (including Afores) accounted for 65.88% of its CPFI holders, while Afore Invercap and Afore Coppel alone accounted for over 10%, at 13.54% and 11.47% respectively.14“Reporte anual 2021,” FIBRAMTY, p. 107, cdn.investorcloud.net/fibramty/InformacionFinanciera/ReportesAnuales/2021-Anual-inf.pdf.

FIBRA Prologis (BMV:FIBRAPL) reported that, during the last three years, “Afore Banamex, through various SIEFORES, ceased to own 10% or more of total outstanding CBFIs.”15“Reporte anual 2021,” FIBRAPL, p. 95, d1io3yog0oux5.cloudfront.net/_b48525585f9cbc05fd5f78a87b297f06/fibraprologis/db/793/7711/pdf/Reporte+Anual+FIBRAPL+2021.pdf.

Meanwhile, Afore Coppel, S.A. de C.V. and Afore Azteca, S.A. de C.V. owned over 10% of FIBRA Plus (BMV:FPLUS), according to the Fideicomiso’s 2021 annual report.

In UPSITE (BMV:FIBRAUP), Afore Coppel owns 32% of the CBFIs while Afore Azteca has 30%.16Reporte anual 2021,” FIBRAUP, p. 144, www.fibra-upsite.com/xcrud/uploads/assets/Reporte_Anual_2021.pdf. Terrafina (BMV:TERRA) stated in its annual report that it is “only aware that Afore Banamex holds more than 10% of outstanding CBFIs.”17“Reporte anual 2021,” Terrafina, p. 120, s3.amazonaws.com/irdublin/companies/terrafina/documents/financialreports/2021-reporte-anual-bmv.pdf.

For Lara, the member of Acción Comunitaria Pedregal, the lack of clear information from FIBRAs and Afores is a problem that is felt especially by younger generations of working adults, for whom access to housing (buying or renting a property in the areas where they grew up) has become unsustainable.

“It’s incomprehensible how FIBRAs work. It’s a topic that has not been disseminated or analyzed by all of us. There is this idea that part of your money that you work to save can be used to generate welfare, but instead it’s created ‘Merchandise City’ (a concept created by Acción Comunitaria Pedregal to denounce the real estate sector’s mercantilistic vision of the city). I think this is not well understood by the entire population and that’s why there’s not much demand for information and transparency,” said Lara.

For the young activist, there is clear anger and a demand from an important part of society that thinks that these commercial practices should somehow be limited. Lara refers to young workers who are part of collectives opposed to real estate projects and who seek to be clearly informed about the investments where they put their savings. These are people who see it as a right to be able to decide how their money is invested. Yet others still are indifferent.

“There is a generational or informal sector that does not feel so attached to the fact that their money is going into these types of projects. But we have another generation in these disputed territories that is in the formal economy and sees how Afores are being used to evict people or intervene in territories where our parents or grandparents lived and where we now live,” she said.

Revolving doors between Afores and FIBRAs

The relationship between Afores and FIBRAs is not limited to the investments that the former inject into the latter, but rather includes the concentrated decision-making influence in a handful of people who have worked for both entities.

At Fibra Shop (BMV:FSHOP), Gabriel Ramírez Fernández is chief financial officer. Previously, he was the financial vice-president of Consar “where he was in charge of the regulation and supervision of Afores (highlighting the changes to the investment regime of the Afores so that they could acquire equity instruments, FIBRAs, among others).”18“Reporte anual 2021,” FIBRA SHOP, p. 228.

Fibra Plus is the one with the most board members (including independents) who are or have been in the Afores industry: Federico Clariond Domene, director of Afore InverCap; Enrique Coppel Luken, proprietary member of the board of Fibra Plus and partner of Grupo Coppel, which controls Afore Coppel where Coppel Luken was CEO and chairman; Eduardo Benigno Parra Ruíz, current CEO of Afore Azteca; and Juan Manuel Valle Pereña, CEO of Afore Coppel and former CEO of Afore XXI-Banorte.19“Reporte anual 2021,” Fibra Plus, p. 190-92.

FIBRA HIPO has Alfredo Vara Alonso as a board member; he was also a board member and part of the audit and best practices committees of Afore XXI-Banorte.20“Reporte anual que presenta de acuerdo con las disposiciones de carácter general aplicables a las emisoras de valores y a otros participantes del mercado de valores por el periodo terminado el 31 de diciembre de 2021,” Fhipo, p. 309, fhipo.com/wp-content/uploads/2022/04/Reporte-Anual-2021-BIVA.pdf. Raúl Patricio Solares Piña, general manager and investor relations director of Fibra EDUCA, “held various positions at Afore XXI since its founding, from assistant sales director to commercial and marketing director.”21“Reporte anual por el ejercicio que terminó el 31 de diciembre de 2021,” FIBRA EDUCA, p. 225, fibraeduca.com/media/fibraeduca/pdf/20220429-informe-anual-2021.pdf.

In Fibra Inn (BMV:FINN) and Fibra Monterrey, Santiago Pinson Correa is an independent member of the technical committee and independent director, respectively. In 2019, he was vice-president of the asset management department at Afore Invercap.22“Reporte anual que presenta de acuerdo con las disposiciones de carácter general aplicables a las emisoras de valores y a otros participantes del mercado de valores por el periodo terminado el 31 de diciembre de 2021,” FIBRA INN, p. 264, www.fibrainn.mx/assets/docs/reporte-anual-2021-vf_626c403b6399b.pdf.

Juan Carlos Calderón Guzmán is also a member of Fibra Monterrey’s technical committee and sits on the investment committee, the indebtedness committee, the audit committee, and the corporate practices committee, of which he is chairman. Calderón Guzmán is a board member of Afore Invercap.23“Reporte anual 2021,” FIBRAMTY, p. 90, cdn.investorcloud.net/fibramty/InformacionFinanciera/ReportesAnuales/2021-Anual-inf.pdf.

For its part, Terrafina’s debt committee chair and ESG committee member, among others, is Carmina Abad, who was responsible for institutional business development at Afore MetLife.

FIBRAs must ensure adequate housing

Since 2011, the Macquarie Mexico Infrastructure Fund (FIMM), in which several Afores invested,24Sergio Meana, “La consulta a las comunidades indígenas constituye una obligación,” El Financiero, 12 August 2015, www.elfinanciero.com.mx/economia/la-consulta-a-las-comunidades-indigenas-constituye-una-obligacion. together with Grupo Mitsubishi and the Dutch pension fund PGGM,25“PGGM embroiled in conflict with Mexican wind farm,” DutchNews, 26 July 2013, https://www.dutchnews.nl/news/2013/07/pggm_embroiled_in_conflict_wit. wanted to erect the Mareña Renovables wind farm in Oaxaca. The project faced opposition from neighboring communities, such as the Ikoots people of San Dionisio del Mar, because the developers had falsified their free, prior, and informed consent.26“Inter-American Development Bank Confirms Mexico Wind Farm Project Violated Indigenous Peoples Policies,” Business & Human Rights Resource Centre, 14 October 2016, www.business-humanrights.org/en/latest-news/inter-american-development-bank-confirms-mexico-wind-farm-project-violated-indigenous-peoples-policies. Under pressure, in 2017, Macquarie Mexico sold its stake to Mitsubishi.27“Declaración del cuarto trimestre 2017 del Administrador,” Fondo de Infraestructura Macquarie México, www.bmv.com.mx/docs-pub/eventore/eventore_820284_2.pdf.

Mareña Renovable did not meet ESG criteria; however, Afores nevetheless invested in FIMM. When FIBRA Macquarie (BMV:FIBRAMQ) exited the project, it was criticized because the costs of its decision were borne by Mexican retirement savers through their commission costs.28Darío Celis, “Pagó Mitsubishi cerca de 717 mdp a FEMSA y Macquarie por parque eólico en Oaxaca,” Excélsior, 28 December 2012, www.excelsior.com.mx/opinion/2012/02/28/dario-celis/814153.

ESG criteria propose to avoid cases such as Mareña Renovable. However, these criteria may not solve the underlying issue, which, according to the international organization The Shift, is to regulate institutional investment in housing, including FIBRAs.

In the second directive of its report “The Shift Directives: From Financialized to Human Rights-Based Housing,” the organization specifies that “the disproportionate resources regularly managed by institutional investors give them a significant competitive advantage over private buyers. For example, many institutional investors do not need to obtain financial approval from banks for their purchases — they can easily raise resources, pay cash, have access to insider information to find properties, and can make higher bids to secure properties.”29“The Shift Directives. From financialized to human rights-based housing,” The Shift, 2 June 2022, p. 13, make-the-shift.org/wp-content/uploads/2022/06/Directives-Updated-22-June.pdf.

The report also indicates that institutional investors are beneficiaries of tax policies, such as tax exemptions or lower rates. In Mexico, FIBRAs are exempt from paying the Income Tax (ISR),30“Los beneficios fiscales de invertir en FIBRAs,” Hablemos de Bolsa, BMV, 25 September 2019, blog.bmv.com.mx/2019/09/los-beneficios-fiscales-de-invertir-en-fibras. as are “individual residents” who own Mexican FIBRAs certificates listed on the stock market.31“Worldwide Real Estate Investment Trust (REIT) Regimes,” PwC, October 2019, p. 65 www.pwc.com/gx/en/asset-management/assets/pdf/worldwide-reit-regimes-nov-2019.pdf.

To mitigate any negative investment impacts, “human rights, including the right to housing, must be incorporated into investment policies,” according to The Shift. In addition, States must ensure that real estate investors comply with human rights by, for example, adopting mandatory human rights due diligence regulations and that a certain percentage of new housing is priced affordably for the people already living there.

In Torre Mitikah, apartment rents can reach 55,000 pesos per month, according to an online search done for this article.32Departaments for rent in Xoco, Segundamano, accessed November 2022, www.segundamano.mx/anuncios/ciudad-de-mexico/benito-juarez/renta-inmuebles/en-renta-departamento-con-3-recamaras-en-939140111. This is more than double the average rent of 22,134 pesos in the Xoco area,33“Valores de departamentos en renta Xoco,” Propiedades.com, accessed November 2022, propiedades.com/valores/xoco-df/departamentos-renta. where the FUNO complex is located.

Farha said the conversation needs to move away from the idea of investing in housing as a way to secure the future. “I’m not talking about families buying their home with effort, but about reorienting the system and making sure that rents are affordable for life and getting investors to set their sights on other assets. FIBRAs are seen as an alternative asset to invest in, but there must be better places to put money that don’t put human rights at stake.”

ESG criteria

It is only recently that Afores have proposed stricter criteria in order for their investments to be allocated in assets or projects that comply with ESG principles. Afore XXI-Banorte has made public an ESG questionnaire, modeled on the UN Principles for Responsible Investment, which consists of 95 questions that request documents and evidence to “disclose information about the sustainable objectives of the company or project in order to assess the level of compliance with these factors (ESG) in its investment process.”34“Cuestionario ASG. Incorporación de factores ASG,” Afore XXI-Banorte, February 2019, www.xxi-banorte.com/wp-content/uploads/2020/06/Cuestionario_ESG_CKDs_CERPIs.pdf.

In 2019, Consar issued provisions for Retirement Savings Systems to incentivize the mandatory inclusion of ESG factors in order to “provide investors with a transparent, rules-based mechanism to identify entities that may be prone to disputes and help obtain lower long-term portfolio volatility.”35“Disposiciones de carácter general en materia financiera de los Sistemas de Ahorro para el Retiro,” Diario Oficial de la Federación, 18 September 2019, www.dof.gob.mx/nota_detalle.php?codigo=5572645&fecha=18/09/2019#gsc.tab=0. Consar plans for ESG investments to represent 38% of total investments, as stated by Gabriel Yorio González, undersecretary of Finance and Public Credit.36Magdalena Martínez, “La Amafore anuncia la creación del subcomité de inversiones sustentables,” Fundsociety, 21 February 2021, www.fundssociety.com/es/noticias/pensiones/la-amafore-anuncia-la-creacion-del-subcomite-de-inversiones-sustentables.

Meanwhile, the Mexican Association of Afores (Amafore), which includes nine of the ten existing Afores, created an ESG investment subcommittee in 2021 and announced that it is working on a “green taxonomy” so that the Afores have more information about the assets in which they wish to invest.37“Amafore crea subcomité de inversiones ASG,” Axis Negocios, 22 February 2021, www.axisnegocios.com/breves.phtml?id=94155.

Amafore and Afore XXI-Banorte were not available for interviews requested for this article.

According to Luisa Montes, director of EcoValores, the Afores have not yet “abandoned investments because they think something is wrong. If they see an investment with environmental or social problems, they work altogether with that company or FIBRA to change its practice. It’s probably not a bad investment and someone else is going to invest or lend to them. It’s preferable to make sure that they improve their performance.”

Some FIBRAs have also declared their intentions to protect the environment and comply with ESG principles. Following Mareña Renovables, FIBRA Macquarie’s cumulative green building certification coverage represents 30% of its gross leasable area.38“Fibra Macquarie México reporta resultados del segundo trimestre de 2022,” Bnamericas, 28 July 2022, www.bnamericas.com/es/noticias/fibra-macquarie-mexico-reporta-resultados-del-segundo-trimestre-de-2022. Even FUNO, despite the controversy surrounding Torre Mitikah, debuted by issuing sustainable bonds and obtained 8.1 billion pesos and also a bank “green credit” line for 300 million USD, which were used precisely to finish building Mitikah.39Verónica González, “Fibra Uno obtiene línea de crédito verde por 300 mdd,” Real Estate Market & Lifestyle, 18 May 2022, www.realestatemarket.com.mx/noticias/163-credito/37648-fibra-uno-obtiene-linea-de-credito-verde-por-300-mdd.

“I feel that they could be using ESG questionnaires to say ‘look, we do comply with ESG principles, come and invest.’ The problem is that those ESG questionnaires almost never discuss human rights and certainly not the right to adequate housing, tenants’ rights, issues around affordability, and commitments not to make property unaffordable. All of that is rarely in the questionnaires, let alone in ESG policies,” said Farha, an advocate who specializes in economic and social rights.

According to Montes, answering the questionnaire is not simple and FIBRAs need to hire consultants to do it; however, “no FIBRA is going to say it’s using more water than there is because the government should not be issuing permits if that were the case to begin with,” said the sustainability expert.

The need to consider ESG criteria in Afores’ investments becomes more relevant for SAR, beginning January 2023, when the pension reform, which contemplates greater employer contributions to workers’ savings, comes into effect.

For Moisés Pérez, the change is also an opportunity for ESG criteria, because “it will generate greater monetary contributions that must be placed somewhere. And for that reason, the (investment) committees are beginning to evaluate policies about where they should start directing investments to reward processes that are also in line with general trends of savers, greener investments, which we see being applied in other countries. In Mexico we will have to stick to those policies.”

In order to maintain investments in FIBRAs and in the housing sector in general, it is necessary to require institutional investors to focus not only on short-term returns but also on human rights.

“It’s saying to them ‘do you want to invest in housing? Well, as long as it has beneficial human rights outcomes,’ which means having social housing, affordable housing in perpetuity. That also means getting returns on investment over the long term, at least 25 years,” Farha explained.

1 “Mitikah abre su centro comercial de 120,000 metros cuadrados,” El Economista, 23 September 2022, www.eleconomista.com.mx/econohabitat/Mitikah-abre-su-centro-comercial-de-120000-metros-cuadrados-20220923-0089.html.

2 Verónica González, “Fibra Uno quiere que toda la deuda que emita tenga atributos ASG,” Real Estate Market & Lifestyle, 9 June 2022, www.realestatemarket.com.mx/noticias/capital-markets/37911-fibra-uno-quiere-que-toda-la-deuda-que-emita-tenga-atributos-asg.

3 “Cuentas Administradas por las Afores,” Comisión Nacional del Sistema de Ahorro para el Retiro (Consar), data through October 2022, www.consar.gob.mx/gobmx/aplicativo/siset/CuadroInicial.aspx?md=5.

4 “¡Poder Judicial de la Federación ordena al Instituto de Planeación de la CDMX suspenda reuniones vecinales en Xoco para la aprobación del PGDU y PGOT!,” Statement by Pueblo de Xoco, 5 December 2022, https://twitter.com/PueblodeXoco/status/1599814150074486785?t=OrZ3pc_-_G0SSkS9Fq3Nzg&s=35.

5 “Límites del Régimen de Inversión,” Consar, www.consar.gob.mx/gobmx/Aplicativo/Limites_Inversion.

6 “El SAR en números. Cifras al cierre de septiembre de 2022,” Consar, www.gob.mx/cms/uploads/attachment/file/768624/El_SAR_en_num_sept2022.pdf.

7 “El SAR en números. Cifras al cierre de septiembre de 2021,” Consar, www.gob.mx/cms/uploads/attachment/file/682127/El_SAR_en_num_sept2021.pdf.

8 “Inversión en fibras,” Consar, data through October 2022, www.consar.gob.mx/gobmx/general/panorama_sar/fibras.aspx.

9 “Inversión en fibras,” Consar, data through October 2021, accessed September 2022, web.archive.org/web/20211124094201/http://www.consar.gob.mx/gobmx/general/panorama_sar/fibras.aspx.

10 Response to freedom of information request number 330009522000299, Consar.

11 Response to freedom of information request number 330009522000300, Consar.

12 Recompra de títulos,” Hablemos de Bolsa, BMV, 19 August 2021, https://blog.bmv.com.mx/2021/08/recompra-de-titulos.

13 “Reporte anual por el ejercicio que terminó el 31 de diciembre de 2021,” FIBRA EDUCA, p. 109, fibraeduca.com/media/fibraeduca/pdf/20220429-informe-anual-2021.pdf.

14 “Reporte anual 2021,” FIBRAMTY, p. 107, cdn.investorcloud.net/fibramty/InformacionFinanciera/ReportesAnuales/2021-Anual-inf.pdf.

15 “Reporte anual 2021,” FIBRAPL, p. 95, d1io3yog0oux5.cloudfront.net/_b48525585f9cbc05fd5f78a87b297f06/fibraprologis/db/793/7711/pdf/Reporte+Anual+FIBRAPL+2021.pdf.

16 Reporte anual 2021,” FIBRAUP, p. 144, www.fibra-upsite.com/xcrud/uploads/assets/Reporte_Anual_2021.pdf.

17 “Reporte anual 2021,” Terrafina, p. 120, s3.amazonaws.com/irdublin/companies/terrafina/documents/financialreports/2021-reporte-anual-bmv.pdf.

18 “Reporte anual 2021,” FIBRA SHOP, p. 228.

19 “Reporte anual 2021,” Fibra Plus, p. 190-92.

20 “Reporte anual que presenta de acuerdo con las disposiciones de carácter general aplicables a las emisoras de valores y a otros participantes del mercado de valores por el periodo terminado el 31 de diciembre de 2021,” Fhipo, p. 309, fhipo.com/wp-content/uploads/2022/04/Reporte-Anual-2021-BIVA.pdf.

21 “Reporte anual por el ejercicio que terminó el 31 de diciembre de 2021,” FIBRA EDUCA, p. 225, fibraeduca.com/media/fibraeduca/pdf/20220429-informe-anual-2021.pdf.

22 “Reporte anual que presenta de acuerdo con las disposiciones de carácter general aplicables a las emisoras de valores y a otros participantes del mercado de valores por el periodo terminado el 31 de diciembre de 2021,” FIBRA INN, p. 264, www.fibrainn.mx/assets/docs/reporte-anual-2021-vf_626c403b6399b.pdf.

23 “Reporte anual 2021,” FIBRAMTY, p. 90, cdn.investorcloud.net/fibramty/InformacionFinanciera/ReportesAnuales/2021-Anual-inf.pdf.

24 Sergio Meana, “La consulta a las comunidades indígenas constituye una obligación,” El Financiero, 12 August 2015, www.elfinanciero.com.mx/economia/la-consulta-a-las-comunidades-indigenas-constituye-una-obligacion.

25 “PGGM embroiled in conflict with Mexican wind farm,” DutchNews, 26 July 2013, https://www.dutchnews.nl/news/2013/07/pggm_embroiled_in_conflict_wit.

26 “Inter-American Development Bank Confirms Mexico Wind Farm Project Violated Indigenous Peoples Policies,” Business & Human Rights Resource Centre, 14 October 2016, www.business-humanrights.org/en/latest-news/inter-american-development-bank-confirms-mexico-wind-farm-project-violated-indigenous-peoples-policies.

27 “Declaración del cuarto trimestre 2017 del Administrador,” Fondo de Infraestructura Macquarie México, www.bmv.com.mx/docs-pub/eventore/eventore_820284_2.pdf.

28 Darío Celis, “Pagó Mitsubishi cerca de 717 mdp a FEMSA y Macquarie por parque eólico en Oaxaca,” Excélsior, 28 December 2012, www.excelsior.com.mx/opinion/2012/02/28/dario-celis/814153.

29 “The Shift Directives. From financialized to human rights-based housing,” The Shift, 2 June 2022, p. 13, make-the-shift.org/wp-content/uploads/2022/06/Directives-Updated-22-June.pdf.

30 “Los beneficios fiscales de invertir en FIBRAs,” Hablemos de Bolsa, BMV, 25 September 2019, blog.bmv.com.mx/2019/09/los-beneficios-fiscales-de-invertir-en-fibras.

31 “Worldwide Real Estate Investment Trust (REIT) Regimes,” PwC, October 2019, p. 65 www.pwc.com/gx/en/asset-management/assets/pdf/worldwide-reit-regimes-nov-2019.pdf.

32 Departaments for rent in Xoco, Segundamano, accessed November 2022, www.segundamano.mx/anuncios/ciudad-de-mexico/benito-juarez/renta-inmuebles/en-renta-departamento-con-3-recamaras-en-939140111.

33 “Valores de departamentos en renta Xoco,” Propiedades.com, accessed November 2022, propiedades.com/valores/xoco-df/departamentos-renta.

34 “Cuestionario ASG. Incorporación de factores ASG,” Afore XXI-Banorte, February 2019, www.xxi-banorte.com/wp-content/uploads/2020/06/Cuestionario_ESG_CKDs_CERPIs.pdf.

35 “Disposiciones de carácter general en materia financiera de los Sistemas de Ahorro para el Retiro,” Diario Oficial de la Federación, 18 September 2019, www.dof.gob.mx/nota_detalle.php?codigo=5572645&fecha=18/09/2019#gsc.tab=0.

36 Magdalena Martínez, “La Amafore anuncia la creación del subcomité de inversiones sustentables,” Fundsociety, 21 February 2021, www.fundssociety.com/es/noticias/pensiones/la-amafore-anuncia-la-creacion-del-subcomite-de-inversiones-sustentables.

37 “Amafore crea subcomité de inversiones ASG,” Axis Negocios, 22 February 2021, www.axisnegocios.com/breves.phtml?id=94155.

38 “Fibra Macquarie México reporta resultados del segundo trimestre de 2022,” Bnamericas, 28 July 2022, www.bnamericas.com/es/noticias/fibra-macquarie-mexico-reporta-resultados-del-segundo-trimestre-de-2022.

39 Verónica González, “Fibra Uno obtiene línea de crédito verde por 300 mdd,” Real Estate Market & Lifestyle, 18 May 2022, www.realestatemarket.com.mx/noticias/163-credito/37648-fibra-uno-obtiene-linea-de-credito-verde-por-300-mdd.