Publicly traded companies in Mexico “legitimize” themselves as ESG without being so

3 de May de 2023

Translated from Spanish

Given that reporting on environmental, social, and governance (ESG) factors is not mandatory or standardized in Mexico, listed companies in the Mexican stock market can report on their ESG goals and risks at their discretion. These three criteria are increasingly sought after by investors, mainly in Europe and the United States, driven by regulations in their own countries. Of the 140 companies listed on the Mexican Stock Exchange, 30 form part of the S&P/BMV Mexico Total ESG Index, which tracks firms with the highest ESG ratings. However, less than half of the indexed companies actually publish this type of report and experts question the credibility of the rankings, given that some companies omit information and engage in greenwashing practices, as well as pay for consultancy services to improve their scores.

By Elizabeth Rosales

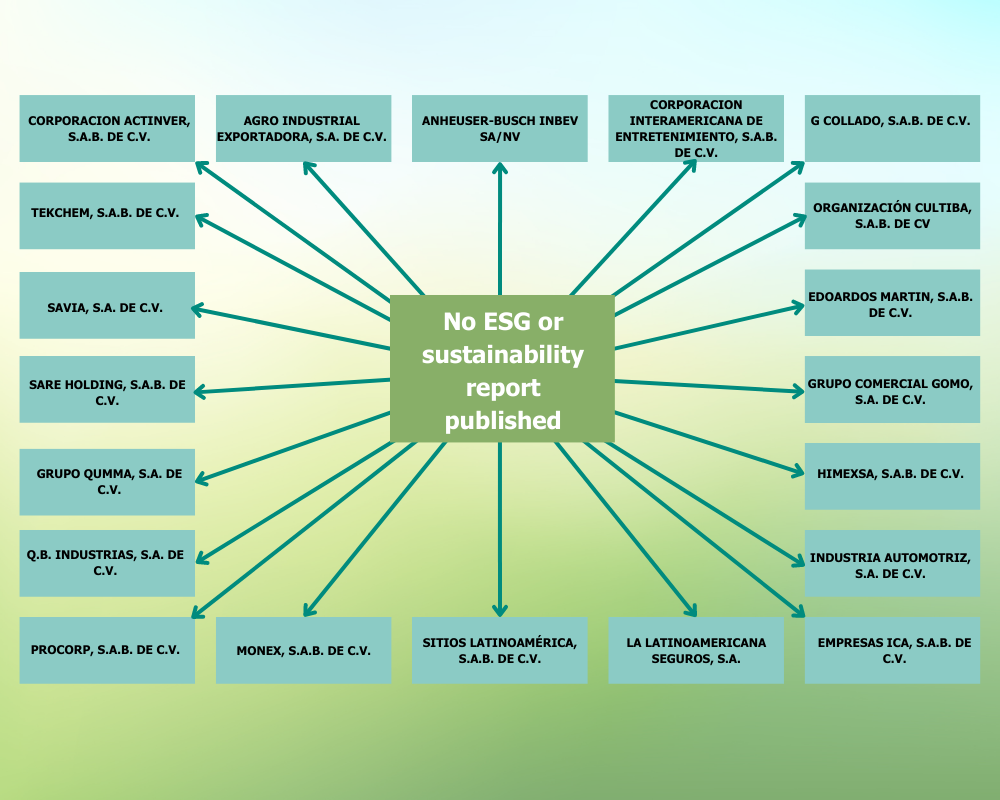

Following corporate responsibility norms on environmental, social, and governance (ESG) issues is becoming more and more important for publicly-traded companies, as investors and consumers increasingly prefer them. However, of 140 companies listed on the Mexican Stock Exchange (BMV), only a minority issue ESG reports because it is not mandatory to do so and because there is no standard that indicates what they should contain, Empower discovered. Even without ESG reporting, some companies obtain benefits such as access to “green” investments or their inclusion in ESG stock indexes without having to commit to addressing or resolving issues of pollution, inclusion, corruption, and human rights, among others, even if they engage in “greenwashing” practices.

There is no standardized definition of what an ESG report is or should be, but the financial sector agrees that they are reports that aim to make transparent business impacts using environmental, social, and corporate governance criteria in order to mitigate risks.

For this article, Empower sent requests to the 140 listed companies on the BMV,1Information accessed on the Mexican Stock Exchange on March 7, 2023. as it is the largest stock exchange in Mexico,2The Bolsa Institucional de Valores (BIVA) has an ESG index called FTSE4Good BIVA Index; however, its fact sheet only lists 10 of the 23 indexed issuers and nine of them are included in the BMV’s index with S&P. to obtain their most recent ESG reports, but only 51 responded. Empower also consulted public information both from the BMV and on the official websites of the listed companies to determine which issue reports and which do not.

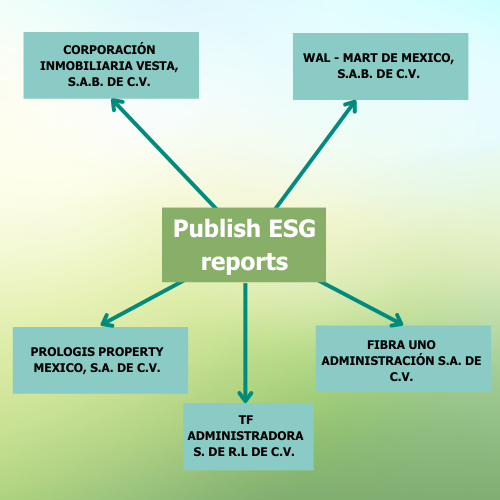

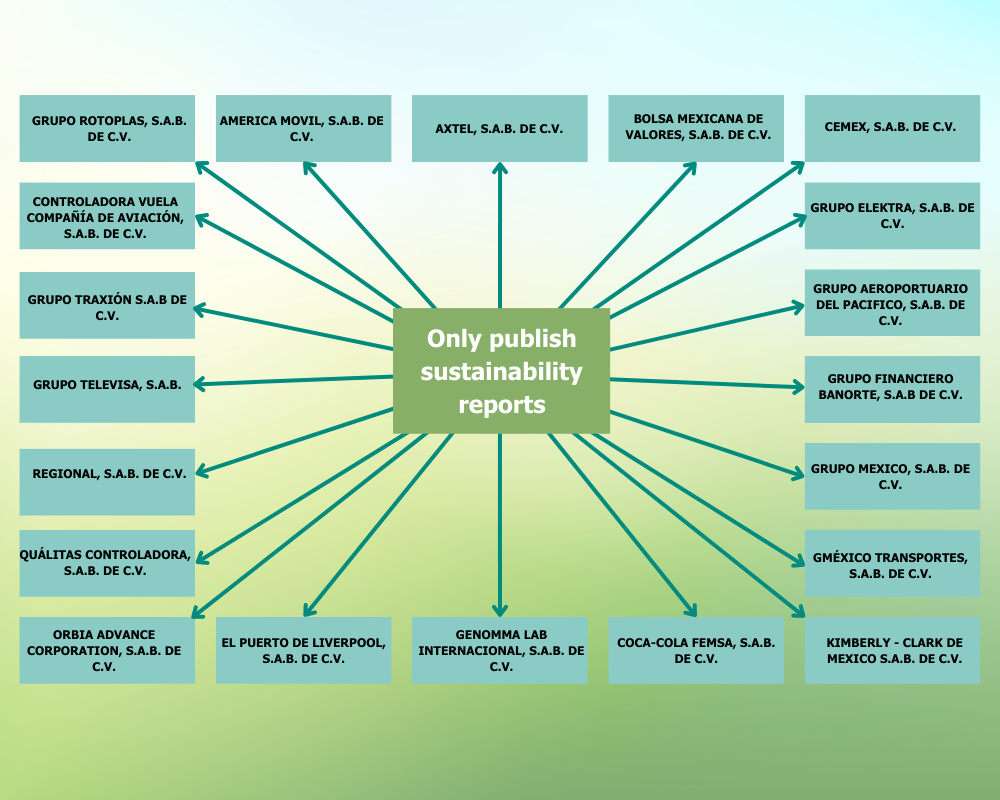

Of the 140 companies, a total of 32 replied with sustainability reports, although ESG and sustainability are different concepts.3“Sustainability vs ESG: What’s the Difference and Why They Matter,” HSBC, 23 February 2023, www.businessgo.hsbc.com/en/article/demystifying-sustainability-and-esg. Sustainability is a principle that encompasses responsible business practices generally, while ESG factors offer metrics to evaluate the performance of companies using environmental, social, and governance criteria.

An even higher level in the ESG industry, where a greater disclosure of information would be expected, is that of those companies included in ESG indexes. In Mexico, the BMV has three indexes that track the ESG performance of companies: S&P/BMV Mexico Total ESG Index, S&P/BMV IPC ESG Tilted Index, and S&P/BMV IPC CompMx Trailing Income Equities ESG Tilted Index. However, only the first one was considered for this article,4“¿Qué emisoras integran el S&P/BMV Total Mexico ESG Index?,” Bolsa Mexicana de Valores, 7 July 2022, blog.bmv.com.mx/2022/07/que-emisoras-integran-el-sp-bmv-total-mexico-esg-index. since it is the only one that has made public its complete list of indexed companies.

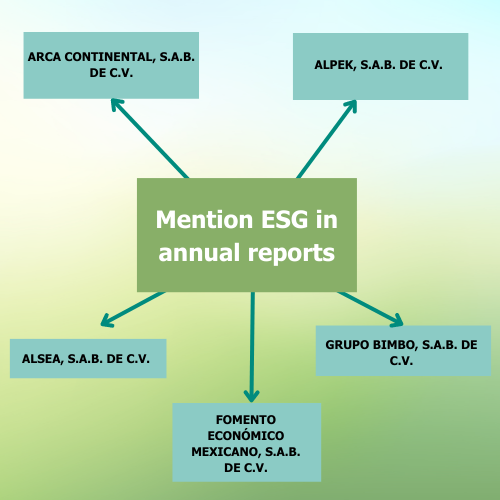

Of the 140 companies listed on the Mexican Stock Exchange, 30 are part of the S&P/BMV Mexico Total ESG Index.5“¿Qué emisoras integran el S&P/BMV Total Mexico ESG Index?,” Bolsa Mexicana de Valores, 7 July 2022, blog.bmv.com.mx/2022/07/que-emisoras-integran-el-sp-bmv-total-mexico-esg-index. However, of those 30, five do not have ESG or sustainability reports, rather only financial reports, and nevertheless they managed to get indexed. Although these financial reports mention the use of ESG criteria, they are not the same as an ESG report due to the absence of disclosures.

Of the remaining companies, 20 have sustainability reports, which is also not the same as ESG, and only five have ESG reports.

Ana Cláudia Ruy Cardia, a lawyer who specializes in ESG and business and human rights issues, pointed out in an interview with Empower that some companies confuse or use ESG and sustainability interchangeably because their reports are commonly prepared by marketing companies and not by legal departments or teams with input from the company’s governance department.

“[These reports] are used in a more market-driven manner,” Ruy commented.

Global Reporting Initiative, the basis of ESG

According to specialists, among other factors hindering mandatory ESG reporting is the fact that the Mexican market is still so small that it is practically impossible for index providers to exclude large companies, even if they do not report correctly or if they receive low ESG ratings.

In Mexico, listed companies are required to periodically publish their annual reports with financial information, according to the Securities Market Law,6“Ley del Mercado de Valores,” Cámara de Diputados del H. Congreso de la Unión, 30 December 2005, www.diputados.gob.mx/LeyesBiblio/pdf/LMV_090119.pdf. but this does not require them to include ESG factors, as reported by Empower in the article titled “Amidst corporate social responsibility labels and greenwashing, ESG criteria arrive in Mexico,” published in January.7“Amidst corporate social responsibility labels and greenwashing, ESG criteria arrive in Mexico,” Empower, 11 January 2023, empowerllc.net/en/2023/01/11/esg-ratings-agencies-mexico.

This is why some companies may partially publish or omit these type of reports as long as they are not required to do so by their investors. In cases where they do, companies often rely on international frameworks, such as the Global Reporting Initiative (GRI),8Global Reporting Initiative, GRI, undated, www.globalreporting.org. a methodology that is used internationally for ESG reporting because it promotes corporate transparency, though it does not prevent the omission of information.

For example, the organization Greenpeace, in its report “Greenwash Danger Zone,”9“Greenwash danger zone,” Greenpeace, 2023, es.greenpeace.org/es/wp-content/uploads/sites/3/2023/04/230420_S04411_gp_greenwash_dangerzone_EN_report_final.pdf. points out that several brands in the fashion industry have failed to report basic information about their operations, such as the volume of materials they use, even when implementing GRI’s methodology. According to Greenpeace, making such information transparent would be useful for monitoring the impact of fast fashion brands on climate change and biodiversity.

“Companies can say whether they are complying with some ESG metrics, but some companies leave out information and do not explain why. This can be done because in the GRI methodology it is allowed, but non-information is also information and this should be questioned by civil society,” said specialist Ruy Cardia.

Reasons to be sustainable

“The ultimate goal of all companies is to make their operations more sustainable. And how can we know if a company is sustainable or not? The only way is through criteria that lead us to measure that sustainability. That is where ESG criteria come in, they are the way to measure sustainability,” said Alain Esau Gallegos López, head of Investor Relations at telecommunications company Megacable, in an interview with Empower.

Megacable does not yet have ESG disclosures, only sustainability disclosures. According to Gallegos López, public companies can receive ESG ratings even if they do not issue ESG reports because rating agencies rely on publicly-available information as long as it fits into at least one of the three ESG pillars.

According to FundsPeople,10“¿Estrategia orientada a la sostenibilidad vs estrategia orientada a factores ASG? Encuentra las diferencias,” FundsPeople, 21 December 2022, fundspeople.com/es/estrategia-orientada-a-la-sostenibilidad-vs-estrategia-orientada-a-factores-asg-encuentra-las-diferencias. an organization comprised of collective investment and asset management professionals in Southern Europe, ESG and sustainability are not synonymous, as the first concept is not limited to “the environmental part, related to the ‘E,’ but also focuses on social (‘S’) and corporate governance (‘G’) criteria.”

In addition, Ruy Cardia mentioned that ESG factors have a risk prevention and mitigation focus.

In Gallegos López’s experience, many companies do not report on ESG factors because they have no need to access international funds that require it. And since Mexican law does not demand it, companies are not obliged or motivated to do so.

“It’s when a fund like BlackRock comes into play and says, ‘hey, I need to invest, but I have a certain amount that can only be invested in ESG issues’ and, in order to access this investment, you have to start disclosing and taking into account these criteria,” said Gallegos López.

When a company has no need to access these resources and does not adopt these criteria, “the company is left a behind,” said Gallegos López, who accepted that this was the case of Megacable until two years ago.

Megacable does not yet issue ESG reports, but it does have an ESG rating from the investment research firm, MSCI, for the reasons explained by Gallegos López previously.

Those with the best scores get financial intelligence firms, such as S&P Global, to include them in stock indexes that rate a company’s performance by sector, industry, and other criteria such as ESG.

The dual role of ESG rating agencies in Mexico

On the other hand, risk ratings are scores that show how strong or vulnerable a company is, mainly to guide the investing public. These evaluations are made by specialized divisions of financial intelligence providers based on their own non-standardized methodologies.

This means that it is the rating agencies — and not the financial system regulator — that decide what information listed companies should publish in order to receive, maintain, or improve an ESG rating.

“All the methodologies that exist to rate them are different and are not comparable, but any methodology is going to analyze 400 or 600 things about the company and it is difficult to say which one is better or more credible,” said Luisa Montes, executive director of Ecovalores, an information agency about environmental, social, and governance issues.

Rating agencies such as MSCI ESG Research11“ESG Reporting Service”, MSCI, undated, www.msci.com/esg/reporting-services. and Sustainalytics12“ESG Risk Rating License”, Sustainalytics, undated, www.sustainalytics.com/corporate-solutions/esg-solutions/esg-licenses. provide consulting services for issuers to improve their ratings and be included in stock indexes.

In Mexico, the National Banking and Securities Commission (CNBV) supervises only seven providers: Fitch Mexico, S&P Global Ratings, Moody’s de México, HR Ratings de México, Verum, DBRS, and AM Best.13“Instituciones Calificadoras de Valores (ICVs), CNBV, 9 October 2017, www.gob.mx/cnbv/articulos/instituciones-calificadoras-de-valores-icvs. Empower requested comments from these rating agencies, but only S&P Global Ratings and HR Ratings de México responded by our deadline. DBRS Morningstar, on the other hand, explained to Empower that it no longer operates in Mexico and declined to comment.

S&P Global Ratings denied that the firm was involved in a conflict of interest, noting that it maintains policies to separate the activities of its different business units.

As for HR Ratings de México, its director of Sustainable Impact, Luisa Adame, commented to Empower that the agency does not offer any consulting services and is “expressly prohibited from giving any type of recommendation or comment” to companies that are rated by them.

“We put a lot of focus on CSA [S&P Global Ratings], so we see what they ask for or what they consider best practice globally and we use that questionnaire as an input for our strategy,” explained Mariana Fernández González, head of investor relations at Rotoplas, a Mexican multinational in the water industry.

In 2015, Rotoplas benefited from a million-dollar contract in the context of the toxic spill committed by Grupo México in the Sonora and Bacanuchi rivers, as reported by PODER.14“Fideicomiso Río Sonora gastó millones en tinacos y escatimó en gastos en salud”, PODER, 31 July 2018, poderlatam.org/2018/07/fideicomiso-rio-sonora-gasto-millones-en-tinacos-y-escatimo-gastos-en-salud-para-las-personas-afectadas-por-el-derrame. The organization documented that one of the owners of the firm, Carlos Rojas Mota Velasco, is a relative of Germán Larrea Mota Velasco, owner of Grupo México, responsible for the spill.

The CSA or Corporate Sustainability Assessment is an evaluation of sustainability practices carried out by S&P Global Ratings, which is responsible for the Total Mexico ESG Index together with the BMV.

S&P Global Ratings offers free ratings to companies that agree to make their results public, but, if a firm wishes to keep these confidential, then it must pay.15“Getting an assessment,” S&P Global, undated, www.spglobal.com/esg/csa/getting-an-assessment#private.

Since this type of contracting is done between private parties, the companies involved are not obliged to disclose the contracts or amounts they pay to the rating agencies and/or stock index creators to improve their ratings.

“That’s a big problem. I am a lawyer and one thought that comes to me when I work with ESG ratings are the rankings of lawyers, because many of these rankings are paid and it is the same with companies that call themselves ESG. It is a market in a way and therefore more than ever we have to be attentive to the real practices of the companies,” said Ruy Cardia, Brazilian ESG specialist.

ESG ratings can be misleading, according to the analysis of the European organization FundsPeople,16“¿Estrategia orientada a la sostenibilidad vs estrategia orientada a factores ASG? Encuentra las diferencias,” FundsPeople, 21 December 2022, fundspeople.com/es/estrategia-orientada-a-la-sostenibilidad-vs-estrategia-orientada-a-factores-asg-encuentra-las-diferencias. as “some of the least sustainable companies on the planet (such as oil or coal extractors) have better ESG credentials than their clean energy counterparts.”

FundsPeople attributes this to the fact that ESG ratings take into account “how a company operates, but not what it does.” In other words, they rate whether companies have anti-corruption, inclusion, forced labor prevention policies, codes of ethics, and ESG strategies, but not how they operate as such.

“The issue is that, when you answer a CSA, they ask you ‘hey, do you have a human rights policy? Yes, does it comply with such things? Yes, has anyone verified it?’ Well no, no one verified it, but, by then, the company involved has already obtained half of the points,” said Fernández González of Rotoplas. In her experience she has seen companies receive high scores despite having pollution scandals or questionable activities, such as the use of fossil fuels.

The twists and turns of sustainability

The lack of standardization, according to Megacable’s Gallegos López, also affects companies because each rating agency has its own methodology and they take into account different indicators. As explained above, 80% of the companies that responded to Empower consider their sustainability report as their ESG report.

For example, managers from the Investor Relations areas of Cydsa, a company dedicated to synthesizing chemical products, the bakery Grupo Bimbo, and Grupo Comercial Chedraui, a supermarket chain, responded to Empower that their sustainability reports are equivalent to an ESG report.

In its 2021 annual sustainability report17“Reporte de Sustentabilidad 2021 – Cydsa,” Cydsa, 2021, cydsa.com/?wpdmdl=4404. Cydsa lists what steps it took to identify, prioritize, validate, and review its ESG objectives, but does not disclose the findings of this process.

In the case of Bimbo, in its 2021 Annual Report18“Informe Anual Integrado 2021 – Grupo Bimbo,” Grupo Bimbo, 2021, https://grupobimbo-com-assets.s3.amazonaws.com/s3fs-public/reportes-2022/bimbo_informe_anual2021.pdf?VersionId=F2Bsctb6Ci_ytb2qLM6EmHSK1J_zCDrk. it does mention its “environmental, social and economic” objectives, as well as the performance of a diagnosis based on these same pillars, but they are never explicitly recognized as ESG practices.

As for Chedraui, its 2021 Annual Sustainable Report19“Informe Anual Chedraui 2021”, Grupo Chedraui, 2021, grupochedraui.com.mx/wp-content/themes/chedraui/index.html/documentos/informacion_financiera/informe_anual/Informe_Anual_Chedraui_Sustentable_2021.pdf. draws conclusions from a materiality study and includes environmental, social, and governance metrics without elaborating on them.

For this article, Empower requested interviews with the Mexican Stock Exchange and the National Banking and Securities Commission to inquire about regulatory issues in the absence of a standard, but their communications teams did not respond by our deadline.

“Everybody wants information on sustainability or ESG issues, but everyone asks for it in a different way, so the best thing would be to standardize,” says Megacable’s Gallegos. “Now, what we are seeing is the most rational step in terms of adopting criteria, knowing what is important for the Stock Exchange or for the Commission as authorities, for the issuers and end users and, in that way, reaching a consensus and arriving at a single document that would be a universal requirement.”

Although the ESG risk posed to a community by a cement company, for example, is not the same as that posed by a company in the food, pharmaceutical, or telecommunications sector, the existence of a regulated ESG framework would force companies to report beyond what they choose to make public, and would save companies the time and effort they currently invest in issuing different reports for different rating agencies.

Finally, the financial sector agrees that ESG factors help mitigate the risks identified by companies, but civil society points out that people and planet have other risks that are not reported and ESG factors, as they are currently applied, do not help mitigate the real impacts of distinct industries on the environment, human rights, or corruption issues, which together affect the habitability of the planet.

1 Information accessed on the Mexican Stock Exchange on March 7, 2023.

2 The Bolsa Institucional de Valores (BIVA) has an ESG index called FTSE4Good BIVA Index; however, its fact sheet only lists 10 of the 23 indexed issuers and nine of them are included in the BMV’s index with S&P.

3 “Sustainability vs ESG: What’s the Difference and Why They Matter,” HSBC, 23 February 2023, www.businessgo.hsbc.com/en/article/demystifying-sustainability-and-esg.

4 “¿Qué emisoras integran el S&P/BMV Total Mexico ESG Index?,” Bolsa Mexicana de Valores, 7 July 2022, blog.bmv.com.mx/2022/07/que-emisoras-integran-el-sp-bmv-total-mexico-esg-index.

5 “¿Qué emisoras integran el S&P/BMV Total Mexico ESG Index?,” Bolsa Mexicana de Valores, 7 July 2022, blog.bmv.com.mx/2022/07/que-emisoras-integran-el-sp-bmv-total-mexico-esg-index.

6 “Ley del Mercado de Valores,” Cámara de Diputados del H. Congreso de la Unión, 30 December 2005, www.diputados.gob.mx/LeyesBiblio/pdf/LMV_090119.pdf.

7 “Amidst corporate social responsibility labels and greenwashing, ESG criteria arrive in Mexico,” Empower, 11 January 2023, empowerllc.net/en/2023/01/11/esg-ratings-agencies-mexico.

8 Global Reporting Initiative, GRI, undated, www.globalreporting.org.

9 “Greenwash danger zone,” Greenpeace, 2023, es.greenpeace.org/es/wp-content/uploads/sites/3/2023/04/230420_S04411_gp_greenwash_dangerzone_EN_report_final.pdf.

10 “¿Estrategia orientada a la sostenibilidad vs estrategia orientada a factores ASG? Encuentra las diferencias,” FundsPeople, 21 December 2022, fundspeople.com/es/estrategia-orientada-a-la-sostenibilidad-vs-estrategia-orientada-a-factores-asg-encuentra-las-diferencias.

11 “ESG Reporting Service”, MSCI, undated, www.msci.com/esg/reporting-services.

12 “ESG Risk Rating License”, Sustainalytics, undated, www.sustainalytics.com/corporate-solutions/esg-solutions/esg-licenses.

13 “Instituciones Calificadoras de Valores (ICVs), CNBV, 9 October 2017, www.gob.mx/cnbv/articulos/instituciones-calificadoras-de-valores-icvs.

14 “Fideicomiso Río Sonora gastó millones en tinacos y escatimó en gastos en salud”, PODER, 31 July 2018, poderlatam.org/2018/07/fideicomiso-rio-sonora-gasto-millones-en-tinacos-y-escatimo-gastos-en-salud-para-las-personas-afectadas-por-el-derrame.

15 “Getting an assessment,” S&P Global, undated, www.spglobal.com/esg/csa/getting-an-assessment#private.

16 “¿Estrategia orientada a la sostenibilidad vs estrategia orientada a factores ASG? Encuentra las diferencias,” FundsPeople, 21 December 2022, fundspeople.com/es/estrategia-orientada-a-la-sostenibilidad-vs-estrategia-orientada-a-factores-asg-encuentra-las-diferencias.

17 “Reporte de Sustentabilidad 2021 – Cydsa,” Cydsa, 2021, cydsa.com/?wpdmdl=4404.

18 “Informe Anual Integrado 2021 – Grupo Bimbo,” Grupo Bimbo, 2021, https://grupobimbo-com-assets.s3.amazonaws.com/s3fs-public/reportes-2022/bimbo_informe_anual2021.pdf?VersionId=F2Bsctb6Ci_ytb2qLM6EmHSK1J_zCDrk.

19 “Informe Anual Chedraui 2021”, Grupo Chedraui, 2021, grupochedraui.com.mx/wp-content/themes/chedraui/index.html/documentos/informacion_financiera/informe_anual/Informe_Anual_Chedraui_Sustentable_2021.pdf.